Sen. Chris Gildon offered his reaction to Inslee’s $79.5 billion budget proposal, which would add $13 billion in taxes over the next four years

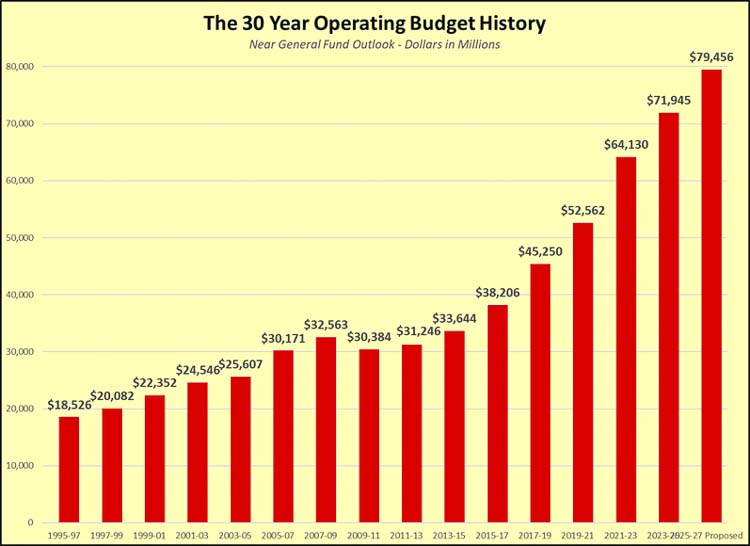

The budget leader for Senate Republicans says the $7.5 billion spending increase in the tax-heavy operating budget proposal unveiled by outgoing Gov. Jay Inslee Tuesday (Dec. 17) shows exactly why state lawmakers are facing a multibillion-dollar deficit.

Sen. Chris Gildon, R-Puyallup, is the new Republican leader on the Senate Ways and Means Committee. He offered this reaction to Inslee’s $79.5 billion budget proposal, which would add $13 billion in taxes over the next four years:

“Governor Inslee proposed a double-digit spending increase in the very first budget he submitted to the Legislature – breaking his no-tax pledge in the process – and he’s going out the same way. Tax-and-spend to the end.

“Just two weeks ago the governor imposed a spending freeze, on the grounds that state government is facing a significant budget deficit. Then he turns around and puts out a budget that would greatly outspend the available revenue and continue to grow the state workforce. So much for holding the line.

“Let’s be clear: there is a deficit ahead, but it’s caused by overspending, not by a recession or a drop in revenue. The governor could have come up with a budget that lives within the additional $5 billion in revenue that is anticipated. Instead, he wants to spend even more and impose additional taxes on Washington employers to help make up the difference. When the cost of doing business goes up, consumers feel it too. His budget would make living in Washington even less affordable.

“The state budget was just over $31 billion when Inslee took office. This new budget of his would put it at just under $80 billion. That’s a staggering amount of growth – it approaches triple the spending while the population of our state has grown by just 14% in the same period.

“Republicans have no shortage of ideas for saving Washington from more tax increases. Some of our proposals have been ignored in past years, but maybe now they will be taken seriously. Governor-elect Ferguson has been talking like he is more interested in spending reductions than tax increases, and he will have the chance to join us in pursuing savings.

“We know there are opportunities to deliver services more efficiently – you just have to look hard enough. Governor Inslee went the other direction.”

Also read:

- Letter: The Missing Skamania Report – The prosecuting attorney is still sitting on itRob Anderson questions why an investigative report into potential County Charter and OPMA violations has not received an outside review after being declined by multiple offices.

- Rep. David Stuebe sponsors high school student from Camas as House pageDiscovery High School student Zoe Southard served as a page in the Washington State House after being sponsored by Rep. David Stuebe.

- Opinion: Democrats side with Tehran while Trump defends AmericaLars Larson argues Democrats are aligning with Iran while President Trump acts against what he calls a national security threat.

- Unnecessary, unaffordable add-ons likely to spell doom for the I-5 Bridge replacement projectThree Southwest Washington legislators argue the Interstate Bridge Replacement’s rising costs and added features threaten its viability.

- WA passes legislation requiring no-cost insurance for state recommended vaccinesHouse Bill 2242 shifts the trigger for no-cost vaccine insurance coverage in Washington from federal recommendations to the state Department of Health.