The latest hike moves it to a range of 4.75 to 5 percent, according to the central banking system’s website

Casey Harper

The Center Square

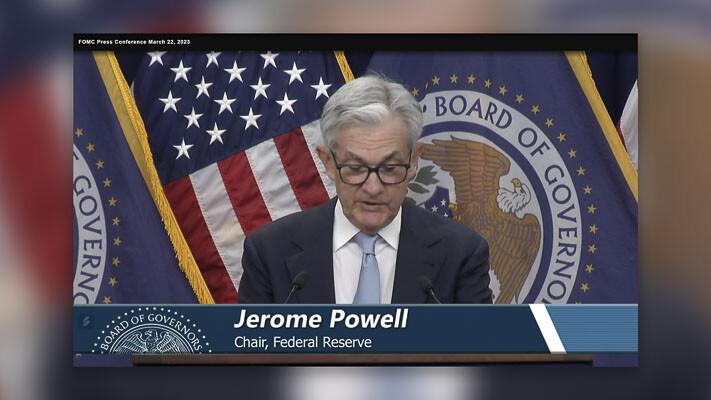

The Federal Reserve announced a key interest rate hike Wednesday, the ninth time it has done so since early 2022 in its effort to combat rising inflation.

The rate got a quarter-point increase to 0.25% to 0.5% on March 17 of last year; the latest hike moves it to a range of 4.75% to 5%, according to the central banking system’s website. Another hike, perhaps a final one in this trend according to policymakers, could move it to 5.1%.

“Recent indicators point to modest growth in spending and production,” the Federal Reserve Board of Governors said in a statement. “Job gains have picked up in recent months and are running at a robust pace; the unemployment rate has remained low. Inflation remains elevated.”

Government reports say 311,000 jobs were added in February, and unemployment rose from 3.4% to 3.6%.

Inflation has soared in the last two years, making everyday goods and services more expensive for Americans. The Feds’ key interest rate was 1% to 1.25% when the impact of COVID-19 slammed the country in early March 2020, and the rate dropped to 0 to 0.25% on March 16, 2020. In the next two years, stimulus and relief funds flowed into the economy as businesses struggled amid lockdowns and mandates; the rate stayed low until inflation took off last spring.

Some experts feared that the recent bank collapses would make the economy too frail to withstand the rate hike, which are aimed at lowering inflation at a cost to economic growth.

“The [Federal Reserve] should pause on Wednesday,” Bill Ackman, CEO of Pershing Square, wrote on Twitter ahead of the news. “We have had a number of major shocks to the system. Three US bank closures in a week wiping out equity and bond holders. The demise of Credit Suisse and the zeroing of its junior bondholders.”

Because of the recent economic scares, others called for an actual decrease in interest rates. The Federal Reserve seemed to acknowledge those concerns in its announcement.

“In assessing the appropriate stance of monetary policy, the committee will continue to monitor the implications of incoming information for the economic outlook,” the group said. “The committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the committee’s goals. The committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

This report was first published by The Center Square.

Also read:

- Business Profile: Joyful Honey and Beekeeping Supplies making a difference for pollinatorsJoy Bochsler’s Battle Ground shop offers honey, equipment, and classes while helping educate the community about protecting pollinators.

- Opinion: Supreme Court’s ruling should end state’s bullying of the La Center School DistrictKen Vance argues a recent U.S. Supreme Court ruling on parental rights in education could influence the ongoing dispute between the La Center School District and Washington state officials over gender pronoun policies.

- State high school basketball: Five local teams to play in quarterfinal games Thursday, March 5Five Clark County basketball teams advanced to state quarterfinal games after Columbia River, Columbia Adventist, Evergreen, and Seton Catholic won Wednesday and Union had already secured its spot.

- Opinion: Neighbors for a Better Crossing urges Oregon Legislators to demand full audit of IBR project, echoing Washington’s HB 2669Gary Clark of Neighbors for a Better Crossing urges Oregon lawmakers to pursue an audit of the Interstate Bridge Replacement project similar to Washington’s HB 2669 proposal.

- Opinion: ‘Privacy’ is not a license for government secrecy – Supreme Court’s Mirabelli Ruling puts Washington’s school parental notification policies on noticeVicki Murray argues a recent U.S. Supreme Court ruling on parental notification policies could affect Washington’s approach to student gender identity nondisclosure in schools.

- WA Senate narrowly advances bill to reduce education spending by $176M through 2031The Washington Senate passed a bill by a 25-24 vote that would reduce and delay some education funding to help address the state’s budget shortfall.

- Opinion: Climate Commitment Act – Washington’s hidden carbon tax hits hardOpinion, columns, Washington state, Climate Commitment Act, CCA Washington, Washington carbon tax debate, Washington gas prices, Nancy Churchill, Dangerous Rhetoric, Washington climate policy, Washington fuel costs, Travis Couture, Washington Department of Ecology, Washington Department of Commerce, Washington carbon credit auctions, Washington cap and trade program, Washington environmental policy