This increase is smaller than the four previous 75 basis point increases but is still a notable increase, putting the range at 4.25-4.5 percent

Casey Harper

The Center Square

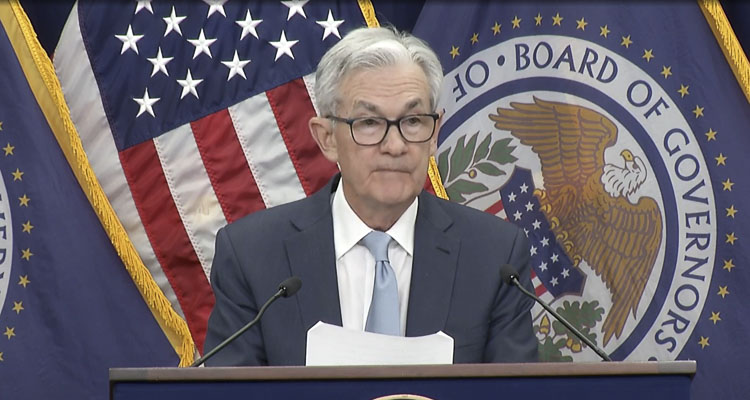

The U.S. Federal Reserve announced a new rate increase of half a percentage point Wednesday in its ongoing effort to curb inflation.

The Fed raised the rate by 50 basis points, as expected, the seventh rate hike this year. This increase is smaller than the four previous 75 basis point increases but is still a notable increase, putting the range at 4.25%-4.5%.

“Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low,” the Fed said. “Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.”

The Fed blamed the Russian war in Ukraine for the price hikes. That war delayed the supply chain and increased costs, but the price increases began long before that war, due in part to trillions of dollars in federal debt spending since the pandemic began.

“The war and related events are contributing to upward pressure on inflation and are weighing on global economic activity,” the group said. “The Committee is highly attentive to inflation risks. The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.”

The increase comes in response to inflation, which has soared during President Joe Biden’s term. The latest federal inflation data shows that those price increases have slowed but not stopped entirely.

Economists say these rate hikes help curb inflation but have negative economic consequences. Raising rates too much too fast can send the economy into a recession.

“We expect that as the Fed moves closer to its terminal rate the market will shift more directly towards growth, especially if valuations become compelling if the market sells off as the economy slows,” said Quincy Krosby, chief global strategist for LPL Financial.

Analysts say the U.S. economy and the possibility of a recession are still in flux.

“Though yesterday’s CPI report was encouraging, we believe the market has overreacted to an easing of inflationary pressures,” said John Lynch, Chief Investment Officer for Comerica Wealth Management. “A drop from 9.0% to 7.0% is likely the easiest of the 200 basis point moves lower that investors hope for … we suspect the next 200 basis point reduction will be much more difficult to achieve as wages, housing and energy prove stickier than consensus believes. Moreover, while the move lower in market interest rates has been received warmly by investors, balance sheet reduction remains a wildcard and may provide further upward pressure on market interest rates in 2023.”

This report was first published by The Center Square.

Also read:

- Full closure: I-5 southbound off-ramp to Exit 11 in north Clark County for maintenance March 3The southbound I-5 off-ramp to Exit 11 for SR 502/Battle Ground will close March 3 from 10 a.m. to 2 p.m. for maintenance work.

- Vancouver Clinic welcomes Katherine Henry as CEO, marking next chapter of physician-led, patient-first care Katherine “Katie” Henry has been named CEO of Vancouver Clinic, succeeding Mark Mantei after his retirement at the end of 2025.

- NWCAVE to honor Sergeant Tanya Wollstein this Sunday with the 2026 Spotlight For Justice AwardSergeant Tanya Wollstein of the Vancouver Police Department will receive NWCAVE’s 2026 Spotlight For Justice Award at Java for Justice on March 8.

- Rep. David Stuebe sponsors high school student from Camas as House pageDiscovery High School student Zoe Southard served as a page in the Washington State House after being sponsored by Rep. David Stuebe.

- Opinion: Democrats side with Tehran while Trump defends AmericaLars Larson argues Democrats are aligning with Iran while President Trump acts against what he calls a national security threat.

- State high school basketball: Seven Clark County teams still playing in final week of tourneysUnion girls and Columbia River boys advanced Saturday, joining five other Clark County teams in the final week of state basketball tournaments.

- Unnecessary, unaffordable add-ons likely to spell doom for the I-5 Bridge replacement projectThree Southwest Washington legislators argue the Interstate Bridge Replacement’s rising costs and added features threaten its viability.