The base rate is still expected to be lower than 2019

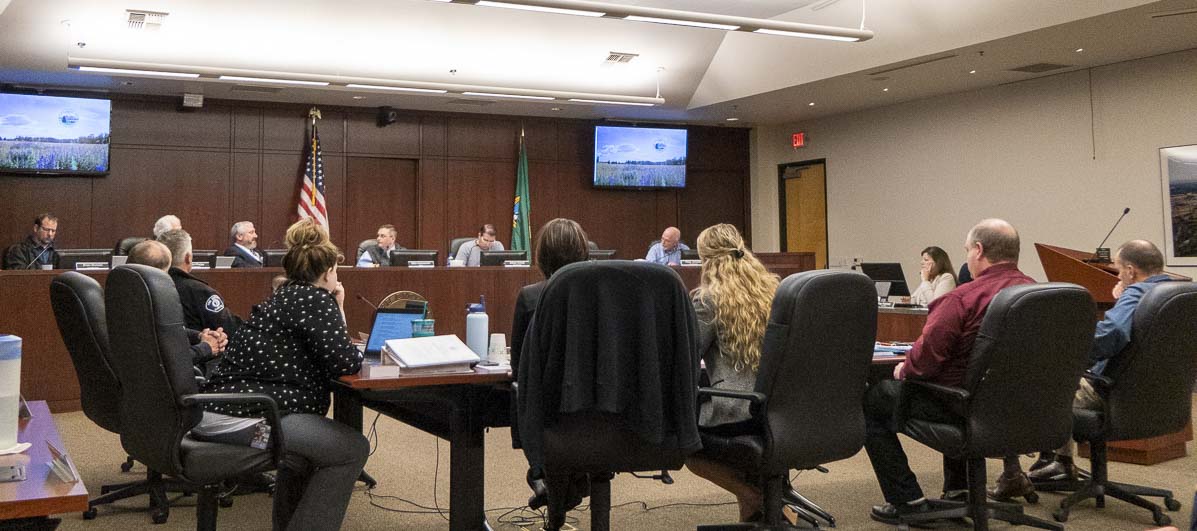

BATTLE GROUND — A divided Battle Ground City Council on Monday agreed to raise property taxes by the state-allowed one percent, and use some banked capacity from previous years. The total increase is 1.69 percent, representing an anticipated $53,511 increase in the city’s general fund budget.

During Monday’s meeting, Battle Ground Finance Director Meagan Lowery explained the increase won’t necessarily be seen by the average property owner. The 2019 levy rate was $1.37 per thousand. With new construction and home prices rising, the base rate for 2020 was expected to be $1.32 per thousand. The approved increase, which uses the state’s maximum allowed one percent increase, plus banked capacity from previous years, will set the rate at an expected $1.35 per thousand.

That change would represent a decrease of around $6.20 in the property tax bill for a home worth the median price of $310,000. A home worth $347,200 would see its bill increase by approximately $44.02 next year.

While the increase is small, overall, several council members acknowledged that it’s never easy to talk about raising taxes.

“This is the one that everyone loves to jump on,” said Deputy Mayor Shane Bowman, “taking the tax increase, right?”

Battle Ground is asking voters in February to approve annexing into Fire District 3. While they’ve agreed to offset some of the cost through a utility tax decrease, annexation would result in a higher tax bill for homeowners in the city.

Bowman defended the increase, however slight, noting that the city is not immune to the impacts of inflation.

“I go out and buy fuel right now and it’s more expensive than it was last year at this time,” said Bowman. “And the city is not immune to that, but the citizens would think we should be, and are, and that we have this big slush fund sitting somewhere.”

The city last year declined to take the one percent property tax levy increase, opting to bank the capacity. Council Member Adrian Cortes said he was concerned that opting to bank the increase would lead to a larger jump this year.

“Fast forward to where we are right now, and that speculation has turned into reality,” said Cortes. “It’s not that I don’t understand and I’m not sympathetic towards the need, especially in the aftermath of the passage of I-976, but I’m going to hold firm on my position in terms of I think this is probably the wrong thing to do.”

Mayor Mike Dalesandro agreed, saying he was uncomfortable approving a tax increase given the upcoming annexation vote.

“When we talked about this last year we had this impending ‘what are we going to do when it comes to public safety?’” said Dalesandro. “I feel like, at least for this next year, we should not take the increase and see what happens.”

Bowman responded that it would be “crazy” to not at least bank the capacity.

“Because you can take it at any time,” added Bowman. “You don’t even have to take the whole thing.”

The council ultimately voted 4-3 in favor of taking the property tax levy increase, with Brian Munson, Dalesandro, and Cortes voting no. In addition to Bowman, council members Steven Phelps, Cherish DesRochers and Philip Johnson voted in favor.