VANCOUVER — Vancouver leaders approved tax abatements for five new, multi-family housing developments Monday night, paving the way for hundreds of new market-rate and affordable units to be added to Vancouver’s rental housing market within the next three years.

As it stands now, the rental market in Vancouver is extremely limited. Nationally, rental markets tend to have vacancy rates around 6 to 7 percent. In Vancouver, the rental vacancy rate is closer to 2 percent.

Peggy Sheehan, Vancouver’s community development programs manager, told the Vancouver City Council on Mon., Feb. 27, during a public hearing on five proposed multifamily housing tax abatements, that the city’s tax abatement program is designed to open up residential opportunities — including affordable housing units — in designated urban areas.

For Vancouver, those designated areas include the city center district and the Fourth Plain Corridor.

To qualify for the city’s eight-year tax abatement program, the development must be multifamily housing and building within the designated urban areas.

To qualify for a longer, 12-year abatement, developments also have to prove that 20 percent of the residential units will qualify as affordable for renters earning 115 percent the area median income. To be considered “affordable,” housing costs, including utilities, must not cost more than 30 percent of a renter’s gross income.

According to the city of Vancouver’s affordable housing definitions, in 2015 the area median income (AMI) for one person was $51,500 with 115 percent of AMI for an individual set at $59,225. To qualify for the city’s 12-year multifamily tax exemption, a property developer must have at least 20 percent of the total units qualify as “affordable” for individuals and families making 115 percent AMI. This means that the maximum affordable rents for an individual would be $1,481. For a two-person household earning 115 percent AMI, the maximum affordable monthly rent is $1,691 and for a family of four earning 115 percent AMI, the highest affordable rent is $2,113.

The tax abatements mean property owners will pay no property tax on the value of the new, multifamily improvements for the length of the exemption, including local tax levies such as Vancouver’s recently passed Affordable Housing Levy. School district maintenance and operations levies, along with school district bonds and library bonds are not affected by the tax abatement.

Sheehan brought five proposed multifamily developments before the city council on Monday night. In total, she said, the city has received 21 exemption requests with 16 projects approved and five in the process of being approved.

“The projects approved today will have three years to achieve occupancy,” Sheehan said.

Those five projects include three in Vancouver’s city center and two in the Fourth Plain Corridor:

VANCOUVER CITY CENTER PROJECTS

Kirkland Tower (8-year tax abatement)

Slated to be built at Columbia Way and Esther Street near the Hotel Indigo, this $17.9 million, 10-story Waterfront Holdings Group, LLC project will add 36 residential condos, a 3,330-square-foot commercial space and 55 on-site parking spots.

The Kirkland Tower condos will sell at market rates, with projected sales prices of between $550,000 for an 800-square-foot unit to $1.54 million for a 2,500-square-foot condo.

City staff projects that the Kirkland Tower development will generate $1.9 million in sales, utility and property taxes over a 20-year period, with a savings of $652,288 in property tax exemptions.

Jefferson Street (12-year tax abatement)

Developed by Farview Drive, LLC, this four-story, $16.4 million project will be located at 807 Jefferson Street and will provide 92 residential units — including 19 units that are affordable for individuals or families earning 115 AMI — and 89 on-site parking spaces.

Projected rents at the Jefferson Street development range from $933 for a studio unit to $1,400 for a two-bedroom, one-bathroom apartment.

City staff projects that the Jefferson Street development will generate $1.88 million in sales, utility and property taxes over a 20-year period, with a savings of $865,235 in property tax exemptions.

Block 8 (8-year tax abatement)

Developed by Block 8 Investment, LLC, this seven-story, $68.5 million development along the Vancouver waterfront at Columbia Way and Grant Street, will add 207 residential units, more than 20,000 square feet of commercial space and 210 on-site and underground parking spaces.

Projected rents for the Block 8 development range from $1,400 for a studio to $2,400 for a two-bedroom, two-bathroom unit.

City staff projects that the Block 8 development will generate $10.19 million in sales, utility and property taxes over a 20-year period, with a savings of $2.28 million in property tax exemptions.

FOURTH PLAIN CORRIDOR PROJECTS

34th Street (12-year tax abatement)

Developed by 34th Street Apartments, LLC, in the 5700 block of 34th Street, this three-story, 21,280-square-foot, $3.3 million project would add 20 housing units — all affordable for individuals and families earning 60 percent AMI — as well as 30 on-site parking spaces.

Rents for the three-bedroom units are projected to cost $1,594.

City staff projects that the Block 8 development will generate $369,295 in sales, utility and property taxes over a 20-year period, with a savings of $164,870 in property tax exemptions.

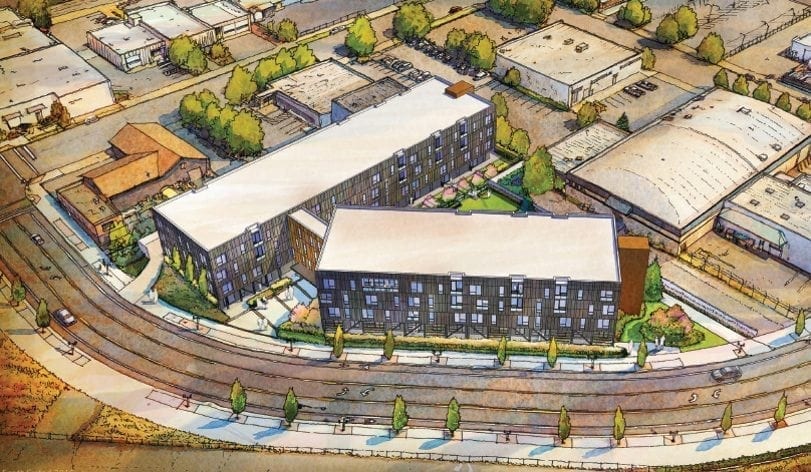

K West (12-year tax abatement)

Developed by DBG Properties, LLC, a Portland-based developer who has built two other tax-abated multifamily housing projects in Vancouver over the past few years, this three-story, $30.6 million development proposed for 5500 NE Fourth Plain Blvd., would add 192 units affordable to residents earning 60 percent AMI and 247 on-site parking spaces.

Projected rents range from $764 for a one-bedroom, one-bathroom apartment to $1,040 for a three-bedroom, two-bathroom apartment.

City staff projects that the K West development will generate $3.54 million in sales, utility and property taxes over a 20-year period, with a savings of $1.75 million in property tax exemptions.

Walter “Skip” Grodahl, CEO of DBG Properties, the developer behind the proposed K West project, spoke at the Monday night Vancouver City Council meeting and said this is his third time coming in front of the council for a tax abatement. His company’s other two properties are known as 13 West and 15 West and also offer affordable housing in a gentrifying area of Vancouver.

Grodahl said some people, including Vancouver City Councilmember Alishia Topper, have asked him if he was going to build a market-rate complex in Vancouver.

“I tried, but the need was greater for affordable housing,” he said. “And this tax abatement is very critical for us as we’ll be 100 affordable at (K West).”

For more information on the city of Vancouver’s multifamily housing tax abatement program, click here.